From High School Dropout To Billionaire

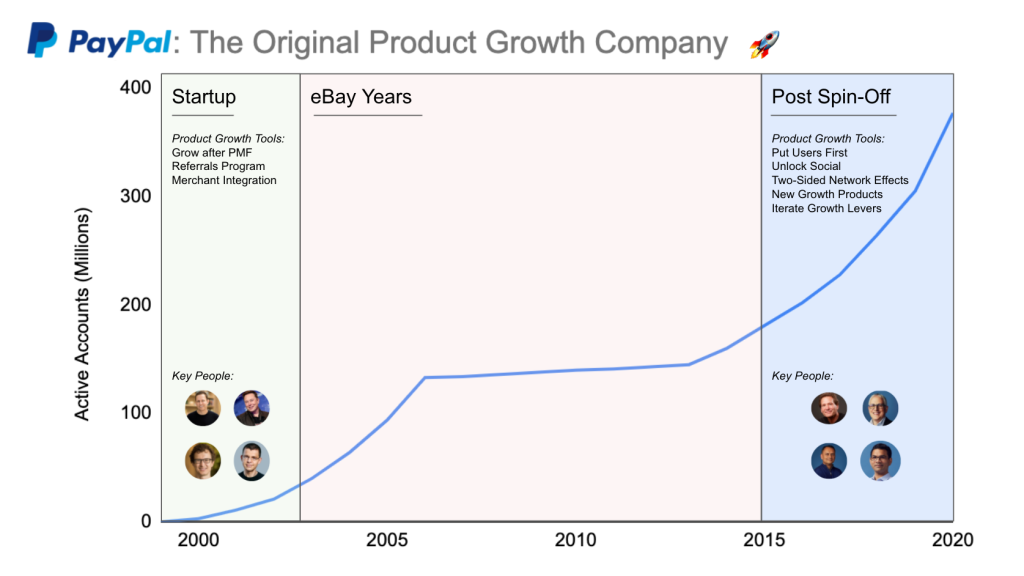

PayPal has been a leading cornerstone in digital payments for many years. It has completely revolutionized how money is transferred and managed online. Under the tutelage of Elon Musk, the history of Paypal has been short but sweet.

Their service has grown from a simple idea in Palo Alto into a global financial technology giant, impacting millions of people, affiliate marketers and small businesses worldwide.

When Vision Meets Talent Anything Can Happen

History of Paypal In Palo Alto

The history of PayPal began in the late 1990s, when two companies – Confinity and X.com, were merged. Confinity, co-founded by Max Levchin and Peter Thiel, focused on developing digital payments and cryptography software.

X.com, which was founded by Elon Musk, aimed to provide online financial services.

The merger of these two companies in 2000 marked the birth of what would eventually become PayPal.

Being the visionary entrepreneur that he is, Elon Musk was instrumental in guiding the company through its early stages.

Peter Thiel, who is well known for his strategic thinking, played a crucial role in shaping PayPal’s business model, and Max Levchin’s technical expertise ensured the platform’s reliability and security.

On This Page

Confinity and X.com

Confinity initially focused on developing a secure way to send money via handheld devices, which eventually evolved into a digital wallet system. This early technology laid the foundation for PayPal’s safe and efficient payment processing systems.

Elon Musk’s X.com initially sought to provide comprehensive online banking services. However, after the merger with Confinity, the company’s focus shifted towards the more promising digital payments sector. The decision to rebrand as PayPal was pivotal, emphasizing the platform’s role in facilitating online transactions.

The merger between Confinity and X.com was the catalyst that created the history of Paypal and has led to a rebranding of the service as PayPal Inc. This new identity reflected a broader vision of enabling digital payments across various platforms. The name “PayPal” quickly became synonymous with online money transfers, offering a user-friendly and secure alternative to traditional banking.

History of Paypal’s Early Growth and Challenges

PayPal was initially fuelled by aggressive acquisition strategies, including a referral bonus program that incentivized new sign-ups. However, in 2002, PayPal went public, and shortly afterward, eBay acquired it for $1.5 billion.

This acquisition provided PayPal with a massive database, and it became eBay’s default payment method. Integrating with eBay was a significant growth driver, and PayPal was established as a trusted online payment solution.

Over the years, PayPal has expanded its services beyond simple peer-to-peer payments. It introduced features like merchant services, which allowed businesses to accept payments, and PayPal Credit, which offered financing options for consumers.

PayPal has continuously evolved its technology to enhance customer experience and security. From implementing robust encryption protocols to developing a seamless user interface, PayPal has prioritized safety and ease of use.

Innovations like One Touch, which allows for quick and secure checkouts, highlight the history of PayPal and its commitment to technological advancement.

The history of PayPal’s journey from a niche service to a global payment powerhouse involved strategic international expansion. By entering markets like Europe, Asia, and Latin America, PayPal broadened its reach and adapted to diverse regulatory environments. Developing partnerships with local financial institutions were crucial in navigating these early markets and establishing a foothold.

E-commerce and the Mobile Revolution

PayPal’s integration with e-commerce platforms has significantly driven its success. The company’s payment solutions are embedded in major online retailers, offering customers a convenient and secure payment option. This integration enhances customer experience and helps merchants increase conversion rates by offering trusted payment methods.

The rise of smartphones transformed the digital payment landscape, and PayPal quickly adapted. The company developed mobile apps and optimized its services for mobile devices, making it easier for people to manage their finances.

A Brief History of PayPal's Role in Cryptocurrency

In recent years, PayPal has made significant strides in the cryptocurrency market. The company now allows account holders to buy, sell, and hold cryptocurrencies, including Bitcoin, Ethereum, and Litecoin.

This move caters to the growing interest in digital currencies and has positioned PayPal as a forward-thinking financial services provider.

PayPal prioritizes security, employing advanced technologies to protect customers against fraud and unauthorized transactions.

The company safeguards personal data with encryption, two-factor authentication, and other security measures. PayPal’s proactive approach to security helps build trust and confidence among its customer base.

PayPal's Branding and Marketing Strategies

PayPal’s branding and marketing strategies have evolved, focusing on trust, convenience, and innovation. The company’s campaigns emphasize its secure and user-friendly services, appealing to consumers and businesses. A consistent message of reliability and cutting-edge technology supports PayPal’s strong brand identity.

Their leadership team, composed of experienced executives from diverse backgrounds, guides the company’s strategic vision. Good corporate governance practices ensure that PayPal operates with integrity and transparency, fostering a culture of accountability and ethical decision-making.

Moving Forward and Future Prospects

Looking ahead PayPal like Google and Microsoft all continue to explore new opportunities in areas like blockchain technology, cross-border payments, and financial services. The company’s focus on innovation and adaptability positions it well to navigate future challenges and capitalize on emerging trends in the digital economy.

PayPal’s financial performance has been robust, with consistent revenue growth and profitability.

The company’s diversified business model, which includes transaction fees, interest from PayPal Credit, and revenue from acquisitions, has provided a solid foundation for financial stability and growth.

Strategic acquisitions and investments have expanded its capabilities and market reach. Notable acquisitions include Honey, a digital shopping tool, and iZettle, a payment service for small businesses. These acquisitions align with PayPal’s goal of providing comprehensive digital commerce solutions.

Have a Question?

F

A

Q

Still need help finding what you’re looking for?

Drop Us A Line & we’ll get back to you within 24 hrs 🙂

Most Common Questions

The Consumer Financial Protection Bureau (CFPB) advises consumers against storing large amounts of cash in apps like PayPal, Cash App, and Venmo.

PayPal has robust security measures to protect your bank account information. These include end-to-end encryption for every transaction, firewalls, and secure financial data storage in a single online vault.

While no system is entirely foolproof, your PayPal account has several protections against hacking.

If someone hacks your PayPal account, you may see unauthorized transactions. It’s important to contact PayPal customer support immediately to report the issue and protect your account. PayPal will typically start an investigation and may reverse any unauthorized transactions, refunding you according to their Purchase Protection policy.

PayPal is a publicly traded company that collaborates with various third-party banks for some of its services. Its banking partners have included Synchrony, Citi, and JPMorgan Chase.